Here are some problems involving percentages from past exam papers.

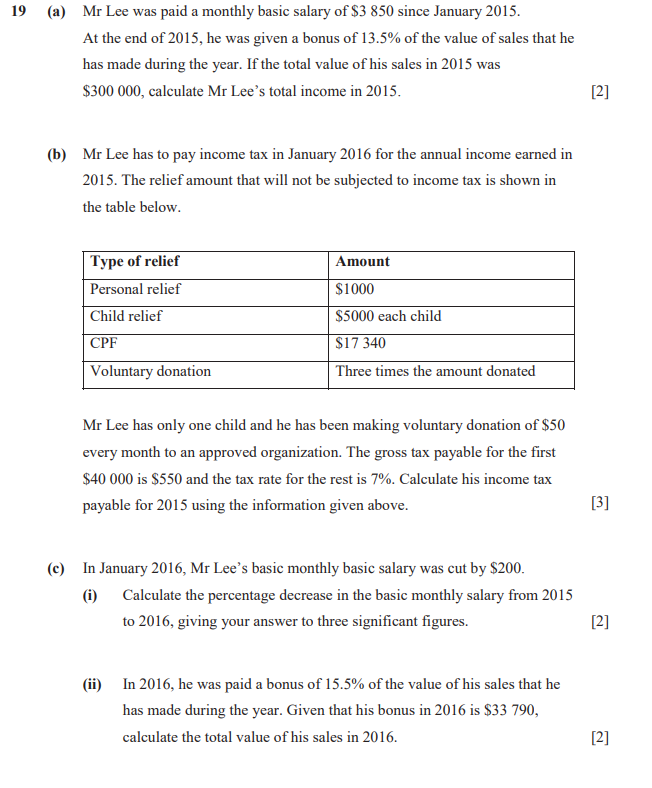

Chung Cheng High 2017 Mid Year Paper Q20

Worked Solutions

(a) Income for the year = Basic + Bonus = $3850 x 12 + 13.5%( $300,000) = $86 700

(b) Taxable Income = $86 700 – $1000 – $5000 – $17 340 – $50 x 12 x 3 = $61560

Total Tax = $550 + ($61 560 – $40 000) x 7% = $2059.20

(c) (i) % decrease = $200/$3850 x 100% = 5.19% ( 3 s.f.)

(ii)15.5% –> $33 790

100% –> 100/15.5 x $ 33790 = $218 000

Value of sales in 2016 = $ 218 000

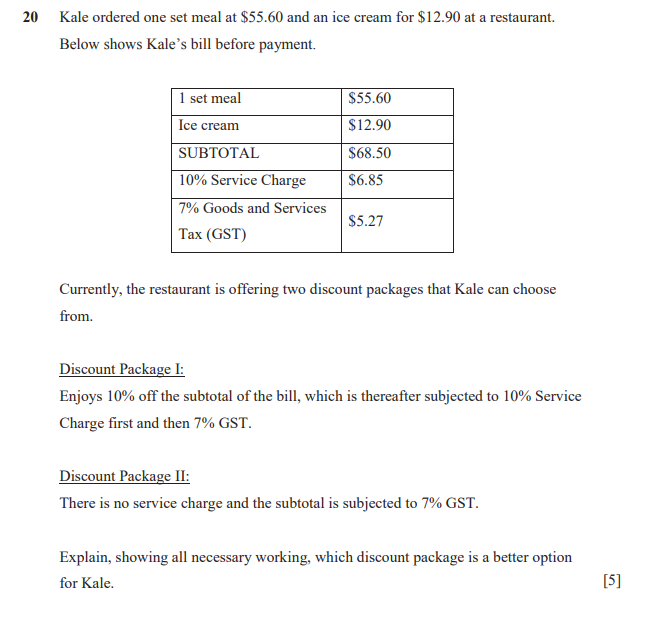

Chung Cheng High 2017 Mid Year Paper Q20

Total amount paid in package I = 90% x $68.50 x 110% x 107% = 0.9 x $68.50 x 1.1 x 1.07 = $72.56 (nearest cent)

Total amount paid in package II = $68.50 x 107% = $68.50 x.107= $73.30 (nearest cent)

Since the amount paid in package I is less than that in package II, Package I is a better option.